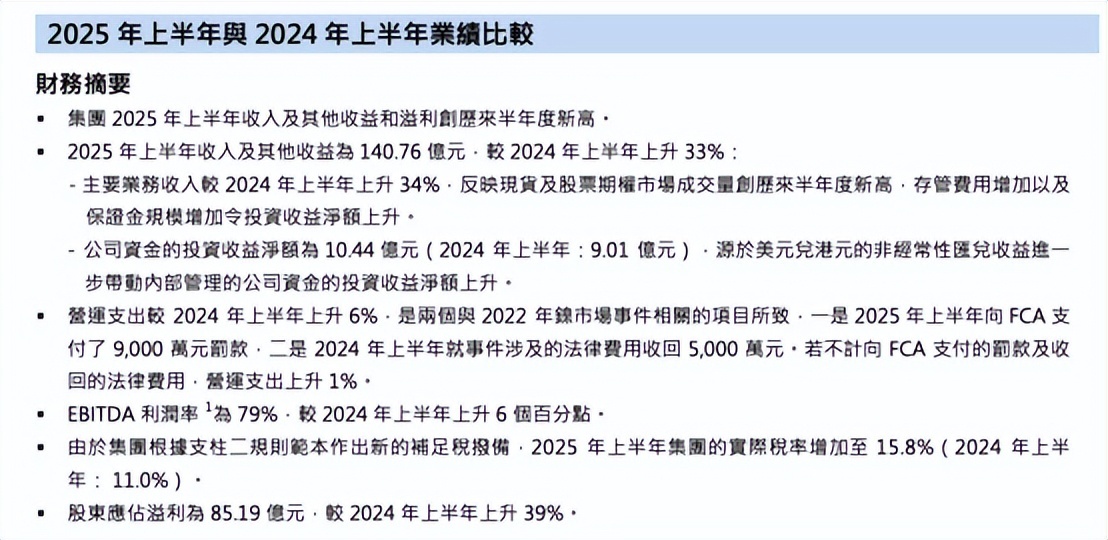

On August 20, hkex released its 2025 interim report, reporting first-half operating income (including other income) of HK $14.076 billion, up 33% year-on-year.

(image: hkex results report)

Speaking at the interim results conference, the Chief Executive of hkex group, Chen Yiting, said that hkex would continue to increase its capital expenditure in areas such as data platform optimisation and trade settlement system upgrades, while adhering to the principle of strategic investment, to remain globally competitive.

Chen stresses that running a successful exchange requires a synergy of key elements such as investors, companies, products, infrastructure and technological empowerment. Based on the concept of“People and goods yard” coordination, hkex will continue to pay attention to changes in market demand, timely response to market development.

Responding to market concerns about the longer trading hours, Chen noted that NASDAQ plans to implement a 24-hour, 5-day trading scheme in the second half of the 2026. Hkex will proceed in a prudent and gradual manner, drawing on the experience of its international peers and taking into account the actual situation of the Hong Kong market. She noted that this process needs to be upgraded trading systems, risk management systems and a mature regulatory framework in order to move forward gradually.

In the area of infrastructure resilience, the stability of hkex’s trading and settlement systems has been proven in practice since the implementation of the severe weather trading scheme. During the last three days of bad weather, the average daily turnover of the Hong Kong stock market was above HK $200bn, according to Chen.

On shortening the cash market settlement cycle, Chan said hkex was actively discussing issues with market participants. HKEX’s technical systems are already capable of supporting the T + 1 settlement cycle by the end of this year, but the timing will be widely consulted by market participants.