“German companies are investing more in China,” German television channel one reported Monday, despite the German federal government’s warning to companies“Not to rely too much on the Chinese market” and its call for more diversified investment, but German direct investment in China rose in the first half of the year from a year earlier, according to the latest statistics from the Bundesbank. The Financial Times quoted analysts as saying yesterday that German investment in China was“Strong”.

$7.3 bn in the first half

German companies invested $4.8 bn in China in the second quarter, after investing $2.48 bn in the first, according to the data. German direct investment in China totaled 7.3 billion euros in the first half of this year, up from the same period last year, Deutsche Welle reported Thursday.

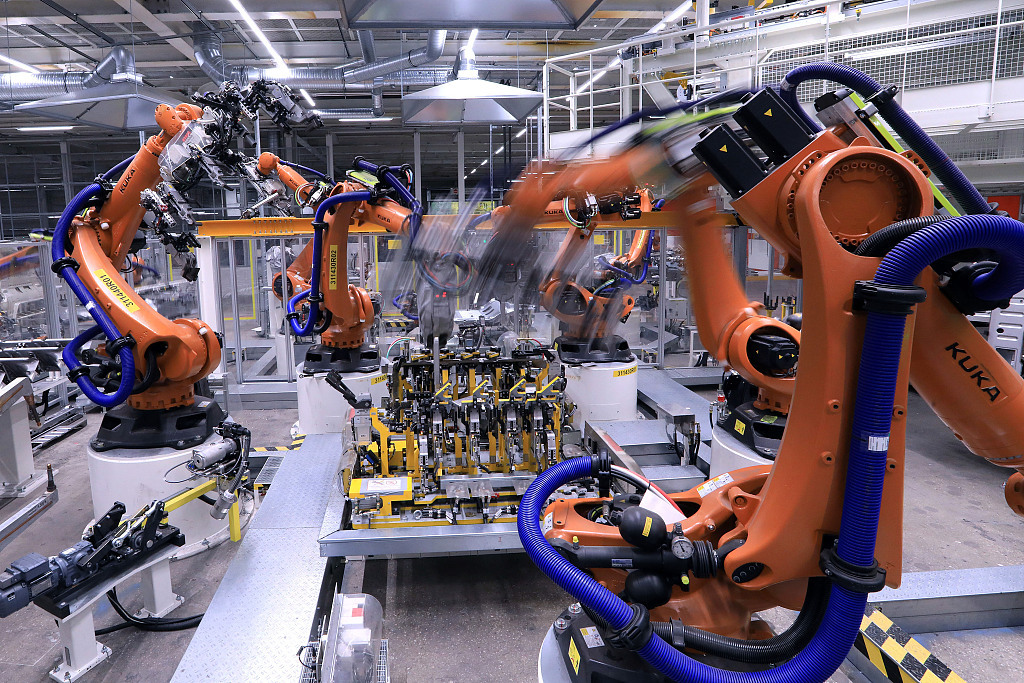

German auto manufacturer production line.

“Diversification” or“De-risk” have been a frequent expression of German economic relations with China recently, according to German television channel DTV 1. The German government last year launched a“China strategy” aimed at reducing dependence on China. Under the strategy, German companies are required to“Diversify” their supply chains and export markets. European Commission President Francois von der Leyen has also repeatedly called on European companies to reduce their ties with China. However, the latest investment data show a different trend. Many German companies, particularly the carmakers that make up the bulk of German investment in China, have ignored warnings from the German federal government about“Growing geopolitical risks in the Chinese market”.

Danielle Wu, an analyst at rhodium, told the financial times that “Strong momentum” in German investment in China would run through the 2024. Wu cited a series of announcements in recent months by German companies about major investments in China, such as Volkswagen’s plan to invest $2.5 bn to expand its production and Innovation Centre in Hefei, Anhui province, bMW plans to invest 2.5 billion euros to expand its Shenyang production base. German investment has consistently accounted for more than 50 per cent of all EU member states’ investment in China in the past five years, largely thanks to the contribution of German carmakers.

Zheng Chunrong, director of the Tongji University German Research Center, told the Global Times on the 14th that German investment in China has been increasing in recent years, german investment in China hit an all-time high last year. A large number of German enterprises have invested in China, especially large German enterprises in the fields of automobile, chemical and machinery manufacturing, “The scale of their investments in China tends to be large, which is an important reason why Germany is the largest source of investment in China in Europe.”

“German companies have their own judgment.”

“The fact that German companies are investing more in China shows that the economic policies of the German federal government and the European Commission towards China are not convincing. German companies have their own judgment,” berlin-based economist Arwed Kessell told the global times on Wednesday, there are two reasons for German companies to make the big judgment: first, Germany’s domestic investment environment is not satisfactory. More than half of respondents at large industrial companies with more than 500 employees are considering moving production abroad, according to a survey published by the German Chamber of Commerce and industry in early August. Germany’s Zew Economic Sentiment Index, which tracks analysts’ expectations for the next six months, fell 22.6 points to 19.2 in August from 41.8 in July, according to data released on the 13th, it was the biggest monthly decline since July 2022 and well below the 29.0 forecast by economists.

“China is actively rolling out measures to encourage foreign investment,” Kessell said, citing efforts to attract foreign investment by expanding market access and easing visa requirements. German employees can now“Just walk away” from China on business trips, even more convenient than going to the United States.

“Deutsche Welle” reported on the 14th, the Cologne Institute of Economic Research shows that last year, German companies in China profits of 19 billion euros.

German plastics machinery maker Arborg decided this month to Wirtschaftswoche production outside the country, including in China, according to German newspaper Wirtschaftswoche, for the first time in its 101-year history. “While moving to China means enduring some criticism, producing in China can increase competitiveness and open up a bigger market,” said one person close to the company. Kessell argues that the German and EU economic communities have a more positive relationship with China than the German and EU politics.

Zheng said that although there were voices in the EU and Germany to pursue foreign economic and trade policies aimed at getting rid of China’s supply chain“De-risk” policies, but China and Germany, China and EU economic and trade are closely integrated. China’s perfect industrial chain and production supporting system, efficient production efficiency and abundant human and energy security, not only let German enterprises enjoy the dividends of the Chinese market, and also let German enterprises to China as an important production base, further enhance the international competitiveness, and fully ensure the healthy and sustainable operation of enterprises.

“The EU and the German government see the risk of economic dependence on a single country in the Russia-ukraine conflict, but German companies see the advantage of stable energy prices and adequate supply in China at a time of high inflation and energy shortages in Europe. So in spite of the political clamour, many companies ended up investing more in China,” said Zheng, from this, we can see that the fundamental reason to decide the choice of enterprises is the law of the market, and not against the law of the market manipulation.

From“Complementation” to“Integration”

German exports to China edged down 2.7 Statistisches Bundesamt cent to $48.2 bn in the first half of the year, according to figures released this week. Imports from China fell 7.9 per cent to $73.5 bn. In the first six months of this year, China ceased to be Germany’s most important trading partner and was overtaken by the US for the first time in years.

German“Le Monde” that some German companies to implement the“In China for China” strategy, the impact of Germany and China’s trade data. In the first half of this year, for example, China’s new energy vehicle sales rose 45 per cent year on year to 3.5 m units. German carmakers have pushed their electric car strategy hard in China, but at home sales have stagnated. “Many German companies are determined to shift production directly to their most important markets through localization policies,” Fritorin Strake, a China expert at the German Industry Federation, told the Financial Times

Zheng Chunrong believes that the sino-german industrial chain has developed from“Complementary” to“Mutual integration. With the continuous expansion of two-way investment between China and Germany, some bilateral trade will be replaced by internal trade. This may be reflected in deeper economic and trade cooperation between the two countries, but the trade data did not show the same growth. “Statistics show that more than 5,000 German companies have invested in China, and 2,000 Chinese companies have invested in Germany,” said Zheng. “The industrial chains of China and Germany are closely integrated, and a lot of trade no longer goes through customs.”. So when we measure economic and trade co-operation, we look at the scale of both trade and investment.”