Japan’s ruling coalition led by Prime Minister Shigeru Ishiguro suffered a crushing defeat in Sunday’s elections, creating a situation in which two camps will compete to form a government. Japan will face a period of political instability, increased uncertainty about policy and economic paths.

Shigeru Ishiguro at the LDP headquarters in Tokyo after Sunday’s House of Representatives election.

Shi’s gamble in calling for an early election backfired. The LDP was punished in the vote last year after it emerged that members of the party had pocketed supporters’ money.

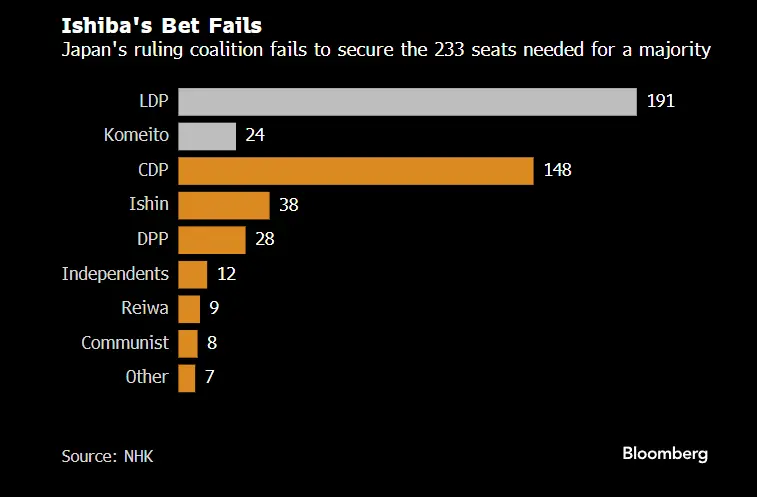

Results from the Japanese broadcaster NHK showed that the Liberal Democratic Party and Komeito party together won 215 seats, falling short of the 233 needed to secure a majority in the lower house, the remaining 250 seats were divided up among more than six parties. The main opposition party, the Constitutional Democratic Party, won 148 seats, NHK said.

The Yen fell as much as 0.68 per cent to a three-month low against the dollar after falling for four straight weeks, raising the risk that Japanese authorities could return to intervening.

Political instability is usually bad for stocks, but Ishiguro could still get enough support to stay in office, and a weak yen tends to support stocks.

The tech-heavy Nikkei 225 and the Topix both opened slightly lower before rising as much as 2 per cent and 1.6 per cent respectively as investors weighed the impact of the election.

Analysts say it is not surprising that the ruling coalition failed miserably, and the market is prepared to price 60-80% of the result. However, the yen and Japanese stocks may come under pressure in the short term as a result of not fully pricing this outcome.

Goldman expects the Nikkei to fall about 2 per cent on Monday, but that will last about a week as investors realise the LDP is struggling to win support from Japan Restoration Party and the DPJ.

Shigeru: I will not resign

At present, Shi Broken Mao has said will not resign. After the vote, Shi said on a television program on the evening of the 27th, “I realize that the current situation is very serious.” “The biggest reason is the complete lack of understanding [ among voters ] about politics and money.”. He also said he would not resign and would carry out his duties.

Asked if he would consider forming an alliance with other political parties, he said no decision had been made, but added that he was willing to work with other parties if the policy was unanimous.

Either way, Japan looks set for a weak government, an outcome that could complicate the BOJ’s prospects. The BOJ is waiting for the right time to raise rates again, and is widely expected to keep them on hold at its next policy meeting on October 31.

That does not bode well for the yen or the Nikkei

“As the political landscape becomes more unstable, it will become more difficult to promote economic policies, including tax increases, such as funding defence spending,” said Masafumi Fujihara, an associate professor of political science at the University of Yamanashi. Without a strong government, it will be harder for the BOJ to raise interest rates and contain the weak yen.”

Takeshi Minami, Chief Economist at Norinchukin Research Institute, said the LDP had suffered a serious defeat and he expected a rate rise in December to be the main scenario.

“There is still some time until December, but the difficulty is that the BOJ has said it will not raise rates in times of market turmoil,” he added. “The impact of the US presidential election also remains to be seen, as market uncertainty increases.”

The LDP faces a situation similar to that of the 1993 lower house elections. It lost its majority but remained the largest party in parliament. After weeks of negotiations, seven opposition parties formed a coalition government, and the LDP stepped down for the first time since 1955. The coalition collapsed within a year and the LDP returned to power.

So far, no other party has offered to join the Coalition to help the LDP stay in power. The leaders of the third and fourth largest opposition parties have expressed no interest in negotiating with the ruling coalition, but may cooperate on specific policy issues.

Tim Waterer, chief market analyst at KCM Trade in Sydney, said: “This could lead to gridlock in the legislative process, at least in the short term, and does not bode well for the yen and the Nikkei.”