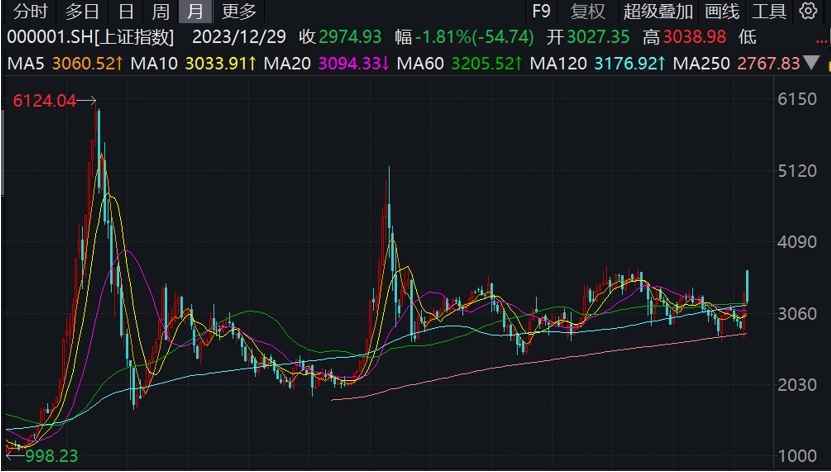

With the recent strong performance of the overall a-share, some international hedge funds began to adjust the layout of ideas. As of October 11, the largest Chinese equity ETF listed in the United States had exceeded $10 billion, reaching $10.58 billion, according to Wind data, it is also the first time that us-listed Chinese equity etfs have topped $10bn; none of the previous bull markets in 2015,2019 and 2020 saw us-listed Chinese etfs break $10bn.

In response, many foreign investors believe that the fundamentals of the Chinese economy are still solid, and with the continuous progress of structural reforms, the cultivation of new drivers and the transformation of old ones are gradually showing results, more growth will emerge.

Fund managers at Belaid, for example, say the outlook 2024 will continue to track investment opportunities in the fourth quarter in line with the following criteria: first, share prices remain at long-cycle lows; The second 2024 is to be able to achieve reasonable operating profits and operating cash flows even though the macroeconomic environment in the first half of the year has been more stressful, and the third is that if there is a significant improvement in the macroeconomic environment, roe and margins have room to improve.

Morgan Stanley Fund also said in an article that, overall, the market as a whole has shown a trend of rising and falling in the near future. At the beginning of the week, the market sentiment reached an excited state, and the turnover hit a record volume, the second half of the market’s decline is a normal technical correction; the current impact of the a-share market is still dominated by domestic factors, foreign factors temporarily weakened, long-term factors than short-term factors.