“Tuesday, France finds itself in yet another crisis,” French prime minister Francois Berlusconi said Tuesday, according to Reuters, it will submit its motion of no confidence on September 8th on a $44bn austerity programme. Reports say the French prime minister’s political gamble to shore up support for his unpopular debt-reduction plan backfired, plunging France into deeper political and financial instability.

“Funding costs will surpass Italy’s in a matter of days.”

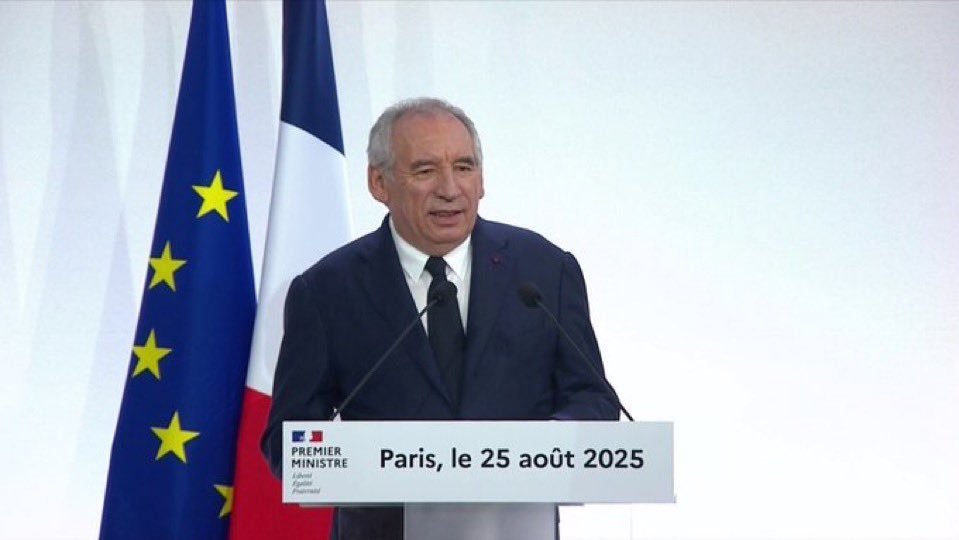

In a press conference on the 25th, Beyroux responded to the 2026 government’s budgetary problems by warning of serious economic and political challenges and calling for immediate action.

On July 15, Beyroux reportedly unveiled his 2026 budget plan, which proposes $44bn in savings aimed at reducing the deficit from about 5.8% of the 2024 to 4.6% of the 2026, and will move closer to the EU’s 3 per cent target over the next few years. The budget plan was criticized by the French opposition immediately after the announcement. The budget also included the cancellation of two national holidays, sparking outrage across France. As a result, Mr Beyroux’s decision to seek motion of no confidence on September 8 was seen as the prime minister’s last “Hail Mary” in the face of non-parliamentary dominance and was expected to face stiff opposition from the main opposition parties.

Beyroux’s actions set off a firestorm. Fears that Maqueron’s government could collapse for the second time in nine months spooked financial markets, with the French stock market suffering a two-day sell-off, with the CAC 40 falling about 1.7 per cent. Meanwhile, the yield on French 10-year bonds, the eurozone’s traditional“Safe asset”, surged above 3.5 per cent, just below Italy’s.

French economy minister Eric Lombard added to concerns on Tuesday by warning that France may need international monetary fund assistance if its fiscal problems are not brought under control. “I can not guarantee that there is no risk of IMF intervention,” Lombard told French radio. He further warned that“If the government were to collapse, the cost of funding in France would exceed that in Italy within days”. If that were to happen, “We would really fall to the bottom of the EU.” But experts generally agree that with the eurozone’s existing stability mechanism, there is little chance that the IMF would intervene directly in France, but its cautionary significance remains clear.

Already mired in debt

“This could lead to the collapse of the government and uncertainty for the country,” the French Le Figaro said. Market fears that a collapse of the French government would further delay the pace of fiscal consolidation, since France is already mired in debt.

France has the third-largest amount of outstanding debt in the world, after the United States and Japan, and it is still growing. According to the report, the French public debt has exceeded 3.34 trillion euros, equivalent to 113.9% of GDP, fiscal deficit for many years above the European Union’s 3% warning line. Rating agencies and investors have repeatedly warned that France’s funding costs will continue to rise if it fails to show a stable and credible fiscal path.

France’s fiscal woes are now intertwined with economic challenges. On the one hand, the scale of debt continues to expand, the growth of fiscal revenue is weak. According to the New York Times, much of this stems from the Maqueron administration’s almost uncontrolled spending. Much of this spending has been spent on protecting the economy from the covid-19 blockade and the European energy crisis triggered by the Russia-ukraine conflict, but the side-effect has been to push up deficits and debt levels further.

On the other hand, measures such as pension reform and budget cuts are highly resistant at the social and parliamentary levels. The IMF made it clear in May that France needed“Significant additional budget efforts” to avoid its debt trajectory spiralling out of control. The French Court of auditors described public spending as“Out of control” and said the country had been cornered. Several economists have warned that France risks being“Punished” by the markets if the government continues to shy away from deep reforms.

At the same time, growth is weak. Growth is expected to hover around 1 per cent this year, well below pre-pandemic levels. Both consumption and investment are subject to purchasing power constraints and uncertainty. The external environment has also worsened: US tariffs on European goods have escalated transatlantic trade frictions, and global financial markets have become more cautious towards highly indebted countries. In this context, the space for French fiscal policy is further compressed.

Will Paris be at the centre of Europe’s next financial crisis?

“French debt is out of control. There is little room for further tax increases. And there is no political consensus. The real question is: Will Paris be at The centre of Europe’s next financial crisis?” asks an article in The British magazine The Spectator.

More broadly, the rise in French bond yields could ripple through global bond markets. As the second-largest economy in the eurozone, French debt is seen as an important component of euro assets. Reuters commented that, “Global bond markets are also in a fragile state, with investors increasingly concerned about high levels of government debt and the ability of major economies to maintain fiscal restraint.” The Eurozone was hit hard by the Greek debt crisis in 2010, protection tools such as the European Stability Mechanism were subsequently established. But now, when signs of crisis emerge in one of the Eurozone’s core countries, market nerves are more sensitive.

“The broader question for the euro is whether the situation in France will weaken investor interest in the euro, or whether it will simply isolate France,” said Chris Turner, head of global market research at Ing, money continues to flow into the eurozone, driven in part by a weaker dollar, and the euro is in a strong cycle. Whether France can resolve the deadlock in the future, whether the spread of local risks, will test the market’s long-term confidence in the euro.