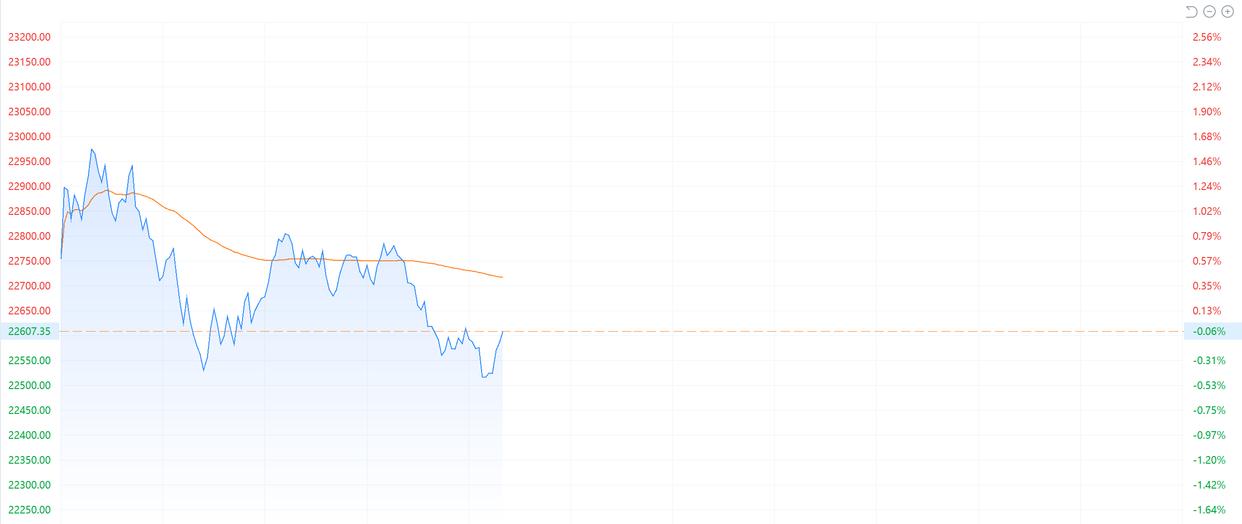

On Feb. 18, Hong Kong’s Hang Seng Index continued its recent strong run, closing at 22,976.811, up 1.590% for the day. “Hong Kong economic daily” after the market reported that the Hang Seng Index from January 13 this year, a low of 18,671 points has risen more than 23% , back to technical bull market.

According to the introduction of Guangfa Fund, a mainland market institution, the term“Technical bull market” originates from Wall Street in the United States, which means that if the key index rises by more than 20% from the recent low, then it can be judged as a“Technical bull market”.

“Hong Kong economic daily” that the recent sharp rise in Hong Kong stocks, seems to be“Bullish”, mainly due to the mainland artificial intelligence (AI) DeepSeek in the end of January set off a global boom.

Hong Kong’s Hang Seng Technology Index of 30 high-tech companies rose 2.54% to close at 5639.05 Wednesday. At January 13’s close of 4,221.92, Hong Kong’s Hang Seng Technology Index had risen more than 30 per cent by February 18, entering an early technical bull market.

The Global Times reporter observed from the board that the Xiaomi Group, Tencent Holdings and Alibaba, which are important heavyweights in the Hang Seng Technology Index in Hong Kong, have recently enjoyed strong gains and performed conspicuously, become an important force to pull up the Hong Kong stock market. Xiaomi Group surged 7.198 per cent to close at HK $48.40 on February 18, hitting a record high. Tencent holdings rose more than 2 per cent throughout the day as its shares regained above HK $500, their highest level since early 2022, while Alibaba also ended the day with a surge as its shares hit their highest level in three years.

The capital boom sparked by DeepSeek has also boosted a number of technology-related sectors in a-shares, attracting large amounts of foreign investment into the Chinese market. Global hedge funds have been buying heavily into Chinese stocks for much of this year, with the strongest buying in four months in early February, Goldman Sachs said in a research note. Global hedge funds have driven the combined value of China’s onshore and offshore markets up more than $1.3 trillion in the past month, according to Bloomberg.

“Hong Kong economic daily” believed that yesterday held the private enterprise symposium has further promoted Hong Kong Stock’s rise. Representatives from Xiaomi Group, Tencent Holdings and Alibaba attended the high-profile event.

Wu chaoming, chief economist of financial holding, told the global times that private enterprises such as DeepSeek and Yushu technology have recently made new breakthroughs in the field of scientific and technological innovation, and new quality productivity has been continuously released, the positive tone of the policy of this private enterprise forum is expected to further enhance the market’s confidence and recognition of China’s scientific and technological innovation ability, and promote the revaluation of China’s technology stocks and China’s assets.