stocks rose while Baidu slumped after foreign media reported that Apple recently began working with the Alibaba Group to roll out artificial intelligence features in the country.

Ali’s shares, down about 3 per cent in pre-market trading but close to their China Standard Time 10 points, suddenly shot up. Baidu group fell 4 per cent in pre-market trading and was down nearly 5 per cent at press time.

Apple is responding to falling sales in China by offering more attractive software features, foreign media reported. In a sign of significant progress, Apple and Alibaba have submitted jointly developed Chinese AI features to Chinese internet regulators for approval, the sources added.

Apple has been testing different AI models from prominent Chinese AI developers since 2023, and last year chose Baidu as its main partner, according to people familiar with the matter. However, co-operation has run into obstacles as Baidu has made progress in developing models for”Apple Intelligence” that do not meet Apple’s standards.

Apple has started looking at other options in recent months, evaluating models developed by Tencent, bytedance, Alibaba and DeepSeek, according to two people familiar with the matter. Apple eventually abandoned the DeepSeek model because the DeepSeek team lacked the necessary people and experience to support big customers like Apple, one of the people said.

On Jan. 29, Alibaba released the Qwen 2.5 Max model, the pedestal model and the command model, which showed strong performance against models such as DeepSeek V3 in the Arena-Hard, LiveBench, LiveCodeBench and GPQA-Diamond benchmarks, cause a great deal of concern in the market. In the future, Qwen will continue to expand the scale and size of the model data to further improve the performance of the model.

At noon on February 11, Jack Ma, Alibaba’s founder, showed up at the Ali Hangzhou campus wearing Alibaba’s black cultural jacket and waving to employees.

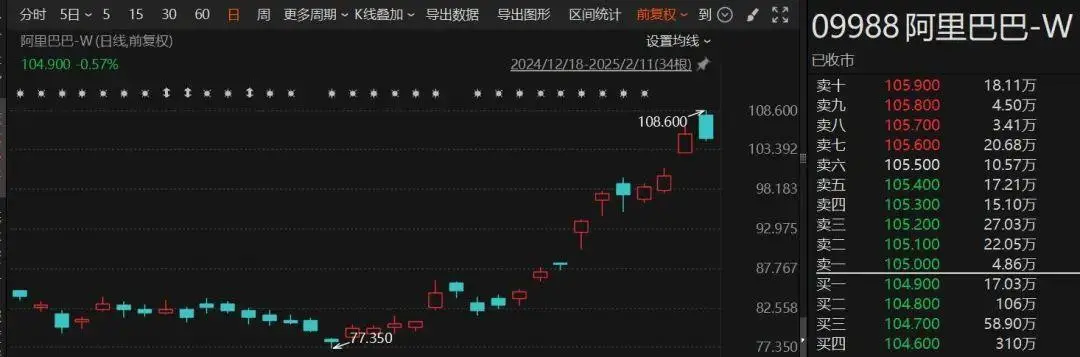

Alibaba shares opened strongly on February 11, touching a session high of HK $108.6. The shares are up nearly 28 per cent year-to-date.

On December 8,2010, Jack Ma made an appearance at Ant’s campus and highlighted Ai in his speech at the 20th anniversary event of Alipay and ant group, “Looking at it today, the next 20 years of AI will change more than anyone can imagine, because AI will be an even greater era,” he says

CITIC Securities believes that the improvement of model capabilities and the decline in deployment costs are expected to drive the rapid upward demand in the c-end and b-end, and the medium and long-term dimensions will become the catalyst for the acceleration of Aliyun’s performance. Considering the gradual improvement of the company’s Taobao Tmall main business fundamentals, the leading strength in the AI field and the strong shareholder returns, we remain optimistic about the company’s medium-and long-term stock price performance, maintain 2026 target price of US $135 ADR and HK $132 a share. maintain”Buy” rating.