South Korean stocks opened lower on the morning of Dec. 4, with the Kospi down 1.97 percent at 2,450.76.

After South Korean president Yoon Seok-hye announced the implementation of“Emergency Martial Law” on the evening of the 3rd, South Korean financial markets were convulsed, and the won fell rapidly against the US dollar, at one point falling to 1,446 won against the US dollar, the lowest in more than 15 years. On the stock market, leading South Korean companies listed on US stock markets fell sharply, State Council of South Korea after the country passed the end of martial law. After South Korean president Yoon Seok-hye declared emergency martial law on the evening of March 3, the South Korean government discussed whether the stock market would open as usual today. Since martial law was lifted, it was decided that the market would open normally.

In response to possible market jitters following the declaration of Martial Law, the Ministry of Planning and finance is prepared to maintain market stability if necessary by providing unlimited liquidity to financial markets and all other possible means. South Korea’s financial commission said this morning that the 10 trillion won stock market stabilization fund will be put into operation at any time. In addition, the bank of Korea held an emergency meeting in the morning to discuss market stability measures. Even less than seven hours after South Korea’s president declared emergency martial law, the country’s economic woes have worsened, according to South Korean economists.

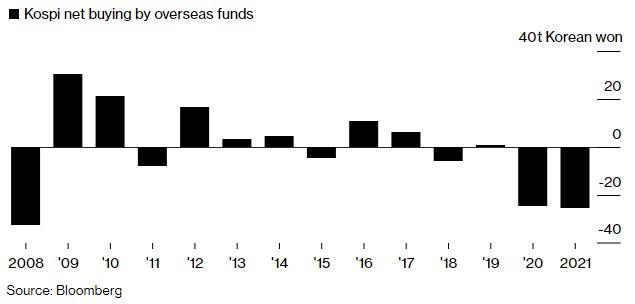

Reporter, Zhu Hongyu: the“Emergency Martial Law” announcement itself has had a negative impact on investors’ psychology, especially foreign investors account for about 30 percent of the Korean stock market, foreign investors sold a net 260 billion won after the market opened today, a phenomenon that will accelerate the decline in South Korean stock prices. On the other hand, “Emergency Martial Law” may also have a negative impact on South Korea’s national credit rating, put further downward pressure on stock and currency markets.