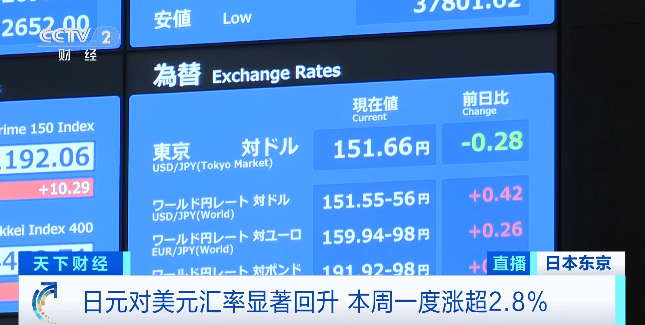

This week, the yen against the dollar has rebounded significantly, the 27th on the New York foreign exchange market, the yen rose back to about a month high.

Shares of Japanese exporters fell in early Nikkei 225 trading as a rebound in the yen dragged them down. On the other hand, the yen briefly broke above Y151 to the dollar overnight on the New York foreign exchange market, hitting its highest level since late October.

The Yen has risen sharply against the dollar this week, up more than 2.8 per cent from last week’s close.

There are two main factors driving the yen’s recovery. First, market investors expect us-japan spreads to narrow. The Federal Reserve may cut interest rates further next month, according to minutes of its November meeting released on the 26th. Tateda, Boj governor, reiterated last week that policy rates would continue to rise if economic and price expectations were met, and would be judged on economic data at every monetary policy meeting. If the Fed cuts rates and the bank of Japan raises rates at the same time next month, the interest rate differential between the United States and Japan will narrow further, which market analysts believe will cause the yen to rise further, at one point, it broke the 150-yen mark.

The Yen’s recovery was also helped by president-elect Donald Trump’s renewed talk this week of imposing tariffs on a number of trading partners, which raised concerns about the outlook for the global economy. With the yen still considered partly a safe asset, risk aversion has helped drive investors to sell dollars to buy the currency, which also led to a rally this week.

In the face of possible uncertainty from Donald Trump, a Japanese think-tank recently published forecasts that the yen could rise back to as high as Y120 to the dollar in extreme circumstances in the first half of next year, the lowest possible exchange rate is 180 yen to the dollar.