Tuesday, WTI crude fell about 5 percent to $65.27 a barrel, its lowest intraday low since December 2021. The Brent Crude fell as much as 4.4 per cent to below $69 a barrel for the first time since December 2021.

By Tuesday’s close, oil prices had eased slightly. WTI October crude ended down $2.96, or 4.31 percent, at $65.75 a barrel. Brent crude for October delivery ended down $2.65, or 3.69 percent, at $69.19 a barrel.

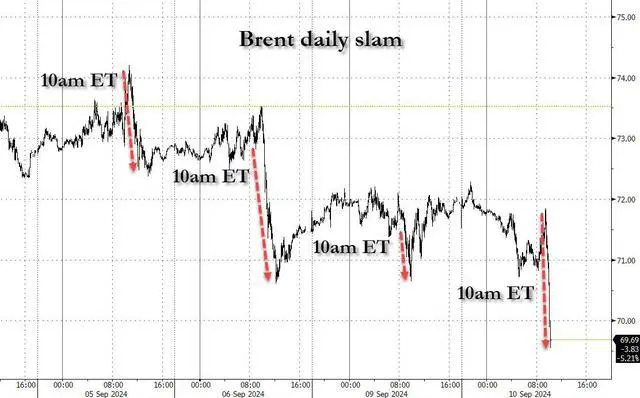

Zerohedge, a financial blog, finds that oil prices have been falling every day at 10am Eastern Time.

The oil price slump was triggered by ample supply, worries about demand and rampant speculative short selling in the crude oil market.

Demand worries

On the same day, OPEC cut its forecast for global oil demand growth in 2024 and 2025. OPEC forecasts that global oil demand will increase by 2.03 m b/d this year and by 1.74 m b/D in 2025, down from previous forecasts of 2.11 m b/D and 1.78 m b/d. In spite of the second cut in demand forecasts in two months, OPEC’s forecasts for global oil demand this year are still far ahead of those of other forecasters.

Recent weakness in a number of US economic data, continued contraction in the eurozone manufacturing PMI, heightened fears of a recession, and Tuesday’s Chinese import and export data, raising concerns about oil consumption demand.

In another sign of weak demand, Saudi Arabia cut the price of its flagship crude in key Asian markets in October, news on Friday showed.

Adequate supply

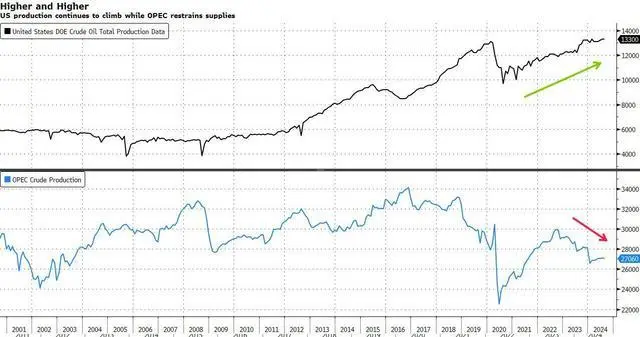

While OPEC + has formed a consensus to delay a fresh supply increase by two months, the glut has been exacerbated by a surge in production from producers outside the organisation.

US crude oil production has been rising, undermining OPEC + ‘s efforts to curb supply. Macquarie expects 2024 US crude production to reach a record 13.9 m barrels a day, with more efficient drilling in the Permian and Buchan basins. Data from Baker Hughes show that the number of crude oil rigs has risen slightly since hitting a low in July.

Speculative short selling

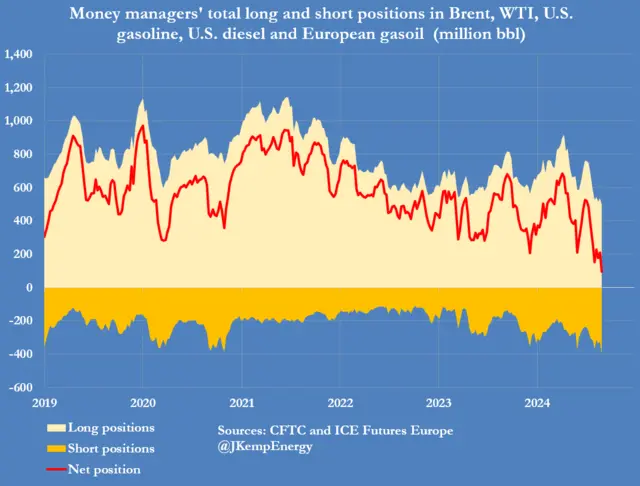

At present, extremely bearish sentiment on oil prices hanging over Wall Street, Goldman Sachs, jpmorgan, Citigroup, HSBC are all bearish. Even Trafigura, a long-time bull, has given a rare warning. The consensus on Wall Street is for a severe oversupply in 2025, when prices could fall to $60. OPEC + agreed to suspend production or temporarily support oil prices, but short-sellers now dominate and the oil price rebound is weak.

Hedge funds once again began to slash their bullish oil bets, with net long positions falling to record lows. However, some analysts point to this as a negative indicator, which usually marks a short-term bottom in the market.

Hedge funds and other fund managers sold the equivalent of 117 million barrels of oil in the six most important futures and options contracts in the seven days to September 3, according to energy expert John Kemp. Total Holdings fell to just 93m b/d, the lowest level in at least a decade.

It should be noted that the position report was released two days before 5 September, when it was reported that OPEC + would delay its planned output increase. But OPEC + ‘s postponement of production increases also failed to halt the downward trend in oil prices.

The U. S. government cut its oil price forecast and raised its output forecast

On the same day, the US Energy Information Administration lowered its outlook for oil prices this year and next:

The 2024 Brent Crude was expected to trade at $83 a barrel, up from a previous estimate of $84. The Brent Crude price is expected to be $84 a barrel in 2025, up from a previous estimate of $86.

The 2024 WTI crude was expected to trade at $78.80 a barrel, up from a previous estimate of $80 a barrel. WTI crude is expected to trade at $79.63 a barrel in 2025, up from an earlier forecast of $81.

The EIA 2024 US oil production at 13.3 m BD, up from a previous estimate of 13.2 m BD, and forecast production of 13.7 m BD in 2025, unchanged from previous forecasts.